BTC LK 21 FEB 20 24 PUT @.45….STO 1/6 @1.15

Monthly Archives: January 2020

TSLA

STC Jan. 10, 460/480 call spread at 16.00, BTO yesterday at 5.90, still long the February 21, 465/485 call spreads.

SPX 1-DTE

$SPX Jan 8 2020 3260/3280 #BeCS (1/2 of Condor) stopped @2.95 – will be a $2.05 loss if the put side expires. Stop was triggered at 3257.5.

BBBY earnings analysis

#Earnings $BBBY reports tonight. Below are details on earnings one-day moves over the last 12 quarters.

Oct. 2, 2019 AC +2.69%

July 10, 2019 AC -3.03%

April 10, 2019 AC -8.75%

Jan. 9, 2019 AC +16.55% Biggest UP

Sept. 26, 2018 AC -20.99% Biggest DOWN

June 27, 2018 AC -3.81%

April 11, 2018 AC -19.95%

Dec. 20, 2017 AC -12.49%

Sept. 19, 2017 AC -15.87%

June 22, 2017 AC -12.12%

April 5, 2017 AC +3.38%

Dec. 21, 2016 AC -9.17%

Avg (+ or -) 10.73%

Bias -6.96%, strongly negative bias on earnings.

With stock at 16.75 the data suggests these ranges:

Based on current IV (expected move into Friday per TOS): 14.68 to 18.82

Based on AVERAGE one-day move over last 12 quarters: 14.95 to 18.55

sed on MAXIMUM one-day move over last 12 Q’s (21.0%): 13.23 to 20.27

Based on UP max only (+16.6%): 19.52

Open to requests for other symbols.

DT

BTO, May 15, 30 calls at 3.00, making a new high yesterday with good volume. I bought options instead of the stock so I know what my maximum loss will be if I am wrong.

Long BA

Two days to expiration. STO BA Jan10 320 put for 2.65.

MRVL Puts

#shortputs

$MRVL STO 1/17 26 puts at .40

Skew??

Been wondering why some IVs and expected moves have been a little off compared to upcoming earnings dates. Totally forgot phase 1 of the China deal is scheduled to get signed on the 15th. That could be throwing things off a little since there’s still always a chance it’ll fall through last second.

Just guessing….

TSLA

#ShortPuts – I can’t believe I’m doing this on a big up day but here goes. Should allow for two rolls before earnings and guessing earnings premium will be jacked this quarter for a possible re-load.

Sold TSLA JAN 24 2020 425.0 Put @ 4.00

BYND

BTO February 21 85/105 call spread at 4.45, stock is breaking out on volume.

X 11 Call/ADMP+AGRX calls

Haven’t been doing any trading lately, both due to the holidays and I’ve been interviewing and preparing for a new job I just started yesterday!

I dipped my toe back in with a long one lot $X 11 Call Feb 21 expiration. Underlying at $11.20 at time of trade.

Both of my $AGRX calls are up about $0.50 a piece, holding through their delayed approval date.

$ADMP calls are still down as well, but planning on holding those same as the Agile calls for now.

Can’t wait to start trading my 401k from my last position once the ACAT goes through!

SPX 1-dte

#SPX1dte Sold to Open $SPX Jan 8th 3185/3205-3260/3280 condors for .80. IV: 8.16%, SPX 3239.

TSLA

Didn’t post this trade the other day due to travels, current events, etc.

1/3/2020 – BTO $TSLA Jan 17 2020 420 Long Calls @34.75.

1/7/2020 – STC $TSLA Jan 17 2020 420 Long Calls – Trailing stop triggered @49.39.

Continuing to watch the ticker, I could have done better with more time and a stop that wasn’t as tight, but, I’ll take it.

#coveredcalls I could not find…

#coveredcalls

I could not find a hashtag for Jade Lizards, so I’ll post here.

Please let me know if another hashtag would be more appropriate.

BTC SQ jade liz for .74 (17 Jan 62/66/67)

Was STO on Dec 23 for 1.43

This mornings upgrade will likely push it above the 66C

TSLA

This morning I bought the 460/480 call spread for 5.90 for the expiration on Friday.It seems like there is a short squeeze going on.

#earnings #shortstrangles STZ Sold Feb….

Sold Feb. 21, 165/205 for 2.50. It is just outside the max down move, just inside the max up move, 65% IVR.

Thanks for the data Jeff.

SQ

#CoveredCalls – This one had been weak and looking weaker so was selling the covered calls pretty aggressively. Then out of the blue caught an upgrade this morning. Rolling now to get the calls back to breakeven on the stock. This roll should be a couple weeks before next earnings so re-evaluate then.

Rolled SQ JAN 10 2020 62.5 Calls to JAN 24 2020 63.5 Calls @ even

This has been a long term repair trade from getting the stock at 80ish in the August implosion…

ROKU

#BullPutSpreads – This should be a couple weeks before next earnings…

Sold ROKU FEB 7 2020 120.0/100.0 Bull Put Spreads @ 2.15

UBER

Sorry forgot to post this one.

12-26 BTO #Fuzzy Buy Jan 24 30 Call Sell BPS 30/29 Net cost $1.37 Up nicely at this time. Earnings near EOM

ROKU EXAS LABU Calls Rolled / LK Covered Call Short Put

#coveredcalls

$ROKU BTC 1/10 149 calls and STO 1/17 152.50 at .60 credit. But stock falling to 139.58. Might be foolish.

$EXAS BTC 1/10 97 call and STO 1/17 102 call for .30 debit. Stock at 101.72. Might be a good idea.

$LABU BTC 1/17 52 call and STO 1/24 55 call at $1 debit. Would gain $3 if called away. Stock at 55.40

#coveredcalls

$LK STO 1/17 36 call at 1.80

#shortputs

$LK STO 2/7 33 put at 2.85

BA BUCS

#bucs

$BA BTO 2/21 340/360 BUCS at 7.43. Zero hedge has vague rumors of Buffet accumulating stock. A more solid thesis I could not find.

AMAT

$AMAT STO Feb 21 57.50 P @1.52

Earnings Feb 12 and probably out by then, but may stay and would take assignment.

Sorry I was a little slow to post this, I was in with the stock at about 60.30

STZ earnings analysis

#Earnings $STZ reports tomorrow morning. Below are details on earnings one-day moves over the last 12 quarters.

Oct. 3, 2019 BO -6.05%

June 28, 2019 BO +4.63%

April 4, 2019 BO +6.54%

Jan. 9, 2019 BO -12.41% Biggest DOWN

Oct. 4, 2018 BO +5.38%

June 29, 2018 BO -5.79%

March 29, 2018 BO +5.31%

Jan. 5, 2018 BO -0.21%

Oct. 5, 2017 BO +5.41%

June 29, 2017 BO +9.75% Biggest UP

April 6, 2017 BO +9.60%

Jan. 5, 2017 BO +0.47%

Avg (+ or -) 5.96%

Bias 1.89%, positive bias on earnings.

With stock at 187.50 the data suggests these ranges:

Based on current IV (expected move into Friday per TOS): 177.59 to 197.41

Based on AVERAGE one-day move over last 12 quarters: 176.32 to 198.68

sed on MAXIMUM one-day move over last 12 Q’s (12.4%): 164.23 to 210.77

Based on UP max only (+9.8%): 205.78

Open to requests for other symbols.

TQQQ Closed

#longleaps

$TQQQ STC 1/17/2020 66.67 calls at 19.60. BTO 11/12/2018 at 8.20. This was the position I had been selling calls during the year. 42 rolls in all. The 19.60 price was from a 21.50 stop. Option closed the day at 23.00. I believe I bottom ticked with a little help from Market maker. Now for the

ROKU LABU EXAS Covered Call / OKTA BUPS (not the eight legged inker)

#coveredcalls

$ROKU STO 1/10 144 call at 3.60

$LABU STO 1/10 56 call at 1.50

$EXAS STO 1/10 97 call at 1.30

#bups

$OKTA STO 2/21 105/115 BUPS at 3.10

SPX Campaign

Closed my Jan 10th 3120/3100 BuPS @ 0.25. Will look to reload tomorrow.

SPX puts closed

#SPX1dte BTC $SPX Jan 6th 3175 puts for .05. Spreads sold for .40 on Friday.

AMD

Seems to be a lot of premium in AMD, earnings not until Jan. 27. Just looking right now.

SEDG

STO February 21, 85 puts at 2.60, stock is at 99.50

#rolling #coveredcalls SBUX Rolled 85…

#rolling #coveredcalls SBUX

Rolled 85 call to February bringing cost basis to 84.21, may pick up dividend of .40. This was an October ratio spread that went bad, was assigned at 92.50.

LK

STO Feb., 30 puts at 2.55, nice pull back today.

Go Eagles!!!!!

Go Eagles!!!!!

Upside Warning canceled

#VIXindicator The Upside Warning was canceled this morning with the VIX spike. We can now watch for a high VIX close to trigger a Downside Warning, or if we can close back below 12.68 we can look for a reinstated Upside Warning.

Expired / Assigned

$SPX 3185/3210 STO 12/27 at 2.60

$ROKU 145 call

$LABU 55 call

$LABU 60 call

$LK 39.50 call

$LK 32 put

$EDIT Assigned at 32. Basis 31.25. Stock at 28.97.

TLT trying for a fill

Trying to get filled on 2/21 129/134/144/149 iron condor @ 1.00.

SPX-ing

#SPX1dte Sold $SPX Jan 6th 3175/3150 put spreads for .40. Looking for small rally into close to sell 3270/3290 call side.

Also selling to close Jan 6th 3265/3280 long call spread…. it has broken even a few times today, then always retreated. Now looks like it will be small loss as I don’t want to risk a full loss by waiting for Monday.

Expiring:

Jan 3rd 3200/3220-3270/3790 condors, sold yesterday for .80.

Jan 3rd 3210/3185 put spreads sold last Friday for 2.60.

SPX Campaign Closed

Placed an order last night. Executed first thing this morning

#spx1dte

$SPX BTC 1/3 3255/3280 BECS at .35. STO 12/31 at 1.30

Go Blues!

#StanleyCup – One year ago today we were in last place in the entire league. We all know what happened after that. It’s that time of year to resurrect the avatar!

#OffTopic 🙂 🙂

#SPX Campaign

Happy New Year to trading

Sold Jan 10th 3120/3100 BuPS @ 0.80 this morning.

UVXY

#BearCallSpreads – If today didn’t generate a sustainable spike in volatility maybe this will…

Sold UVXY FEB 21 2020 17.0/30.0 Bear Call Spreads @ .80

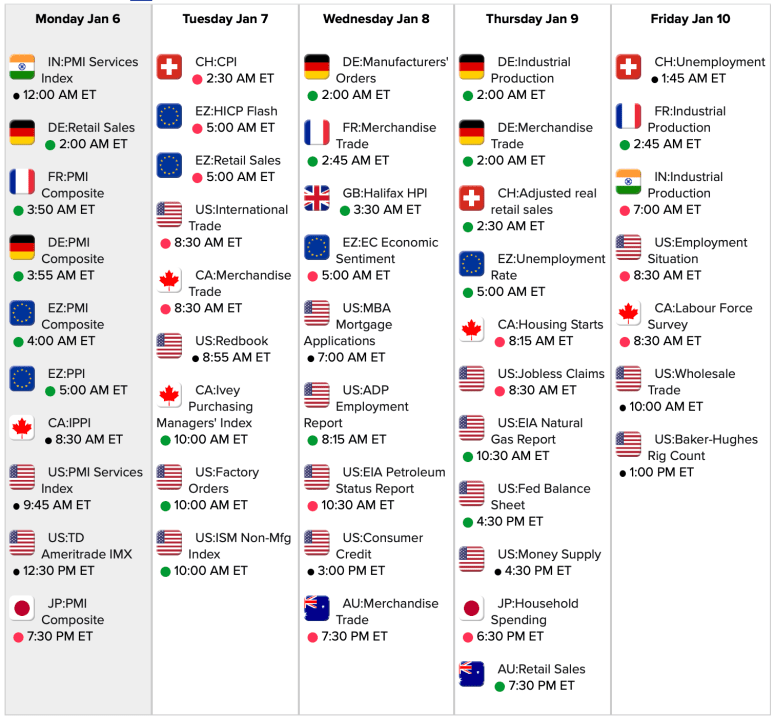

Econ Calendar for week of 1/6/20

#Jobs report is Friday at 8:30am ET

Link to calendar: https://research.investors.com/economic-calendar/

#shortputs ARLO Sold Feb. 5…

#shortputs ARLO

Sold Feb. 5 put for .80, stock is at 4.70

SPY

STO Feb. 14, 300/305 bull put spread at .45

ISRG SOXL SQ ULTA VIX

#ShortPuts #BullPutSpreads #BullCallSpreads #CoveredCalls – A few this morning…

ISRG: Selling the week before earnings outside the expected move and well below the 50 ma almost at the 200ma.

Sold ISRG JAN 17 2020 550.0 Put @ 2.80

SOXL: Finally back in this one.

Sold SOXL Jan 17 2020 230.0 Put @ 3.20

Sold SOXL Feb 21 2020 200.0 Put @ 5.50

SQ: Staying aggressive with the covered sales.

Bought to Close SQ JAN 3 2020 64.0 Calls @ .05 (sold for 1.52)

Sold SQ JAN 10 2020 62.5 Calls @ 1.30

ULTA: Stopped out at tiny profit on an extra sale against stock.

Bought to Close ULTA JAN 17 2020 240.0/210.0 Bull Put Spread @ 2.32 (sold for 2.36)

VIX: Taking off the long side of the double vertical. Holding short put spreads to keep some long volatility.

Sold to Close VIX JAN 22 2020 15.0/18.0 Bull Call Spreads @ .80 (original trade put on for a .05 credit)

STNE

BTC STNE 17 JAN 20 37 PUT @.25…..STO 12/27 @.75….thanks @geewhiz112 for the ticker

AMD Puts Closed / AMZN BUCS Closed

#shortputs

$AMD BTC 1/17 40 put at .10 STO at 1.32. Thank you @ramie77

#bucs

$AMZN Partial STC 1/17 1820/1860 BUCS at 30.00. BTO at 18.54 on 11/27

#perpetualrollingstrangles TSLA I sure don’t…

#perpetualrollingstrangles TSLA

I sure don’t want it to be perpetual;

Rolled inverted 300/430 strangle from Jan. 17 to Feb. 21 for 16.95. I have collected 85.61. Motley Fool now says it’s a buy.

LABU

STO March 20, 40 puts at 2.45

SPX 1-dte

#SPX1dte Sold to Open $SPX Jan 3rd 3200/3220-3270/3290 condors for .85, IV 7.75%, SPX 3247.

KOLD

#BearCallSpreads – Nat gas approaching multi year lows so taking a slightly long starter position for the winter.

Sold KOLD FEB 21 2020 45.0/53.0 Bear Call Spread @ 1.77

SPX long calls

#SPX1dte Went long on the pullback as I think we will stair step higher for next few days; warning, however… what I “think” has not been working too well lately!

Bought to Open $SPX Jan 6th 3265/3280 call spreads for 1.45.

ILMN

#ShortPuts – Selling the week before earnings and at the expected move and below the 50 and 200 day moving averages. Selling the week prior sets up nicely for either a roll into earnings or a juicy covered call sale or another put sale. This is also the weakest ticker in my main watchlist today.

Sold ILMN JAN 24 2020 300.0 Put @ 3.60

Beware: There might be some news driven event the week prior to my sale. The IV is higher for the week of Jan 17 expiration.

T Puts

#shortputs

$T STO 1/10 38.50 put for .48. Ex dividend 1/9. Plan is stock go up in next few days as investors buy for the dividend.

If stock put to me I expect stock to rise into earnings on 1/29. I actually thought this out. Must be a new year.

Good Morning

Good Morning

SPY

STO February 14, 334/340 bear call spread at .55, delta of .15 on the short call.

STNE Call Rolled

#coveredcalls

$STNE BTC 1/10 40 call and STO 1/17 42 call at .98 debit. Stock at 42.11 this morning. Buffet likes it, and I love buffets.

T

STO T Feb 21 2020 T 40 #CoveredCall @.52

One Shoe At A Time BOOT Puts

#shortputs

$BOOT STO 1/17 45 puts at 1.85.

Monster rally continues

#SPX1dte I resolve in 2020 to ask before putting on certain trades: “Is it a better risk to BUY or SELL this spread?” I should have asked that Tuesday when I sold a call spread during this Upside Warning and blistering rally!

Happy New Year everyone! 3,500 on S&P this year? Or will that threatened recession start?