STO SPX BeCS 2750/2745 10/29/2018 @0.35

Monthly Archives: October 2018

SPX longs

#SPXcampaign I bought longs in both directions, because I have no idea which way we’ll head in short term, but I think we’ll be moving strongly in both directions over the next few days. The dates and strikes are sort of randomly chosen near the 3.00 price .

Bought $SPX Oct 31st 2750/2775 call spreads for 3.10.

Bought $SPX Nov 9th 2500/2475 put spreads for 2.70.

Econ Calendar for week of 10/29/18

Be sure to periodically click Home/REFRESH to keep Bistro features updated.

October #Jobs report is Friday, Nov 2nd, 8:30am ET

Link to calendar: https://us.econoday.com/byweek.asp?cust=us

AMZN is trying

If we remain bullish today, $AMZN could end up in the #IronButterfly profit range of 1715 to 1765. Fingers crossed.

TQQQ

Taking the opportunity to roll from November 9, 58.5 calls to November 16, 59 calls for a credit of .18 cents. If I can do this for the next 61 weeks I will be happy.

WDC

More like a falling hindenberg than a falling knife. Actually at this level not a bad dividend. I am working on rolling the #fuzzy down but don’t have time to update at the moment.

Hope everyone has a good weekend.

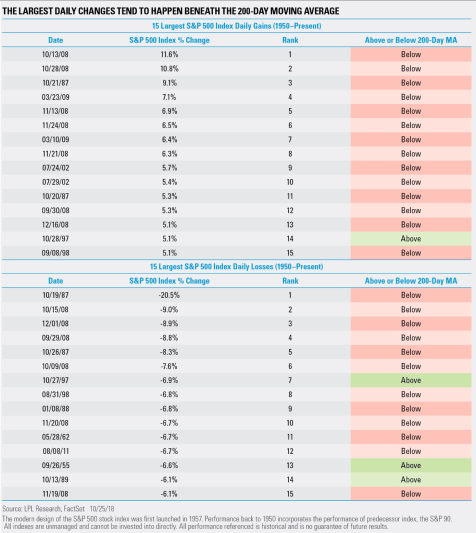

Market Crash

Stock Market Crash of 1929 or the Great Crash, is the stock market crash that occurred in late October, 1929. It started on October 24 (“Black Thursday”) and continued until October 29, 1929 (“Black Tuesday”), when share prices on the New York Stock Exchange collapsed… the dates of the events are a little scary

SPX spreads closed

#SPXcampaign Although I feel there are still drops aheads today, I don’t want these spreads to turn into loses. Small loss on today’s but better win on the one i sold yesterday.

BTC $SPX Oct 29th 2700/2725 call spreads for 5.00. Sold an 90 minutes ago for 4.45.

BTC $SPX Nov 2 2760/2785 call spreads for 3.30. Sold yesterday for 6.25.

I may enter again if we hit resistance.

UVXY strikes added

#VXXGame I may be late on this, but since I don’t remember seeing it posted:

Strikes added in $UVXY up to 122 in all expiries except Jan 2020, which is 120.

Also, June is now available.

New highs today. Rolling my lowest strikes, the Jan ’19 70 calls.

REGN

#ShortCalls – Selling against Jan 2021 in the money put spreads to reduce basis. Replacing this week’s expiration.

Sold REGN NOV 2 2018 365.0 Call @ 1.25

T2108

Now at 9.33

AMZN

#Earnings – Doesn’t look like a big bounce is coming so closing the put side of the iron fly at less than max loss and saving the exercise fees. Big wide iron condor sold separately will cover the loss on the fly (maybe even a net small winner). Wild earnings week that was overall green but not sure if it was worth it…LOL

Bought to Close 1750/1720 BuPS @ 29.58 (saved .42)

#shortstock RSX Oct. 10, sold…

#shortstock RSX

Oct. 10, sold short 100 shares of the Russian ETF for 20.65, bought to cover today for 20.12. Still need more weakness in Denny’s, strength in everything else.

A TRADE: Doing what I know.

TWLO STO 11/2/18 70.0 CALLS @1.13 Naked for now.

TWLO

#ShortStrangles – Obviously not decaying as quickly as I’d hoped. Earnings in a couple weeks so I’ll look at it again there. Taking this one for a small winner…

Bought to Close TWLO NOV 2 2018 60.0/80.0 Strangles @ 1.49 (sold for 2.06)

SPX breaks open low

#SPXcampaign

BTC $SPX Oct 26th 2625/2600 put spreads for 4.30. Sold yesterday for 2.20. Missed my fill on the order to close yesterday.

Sold to Open $SPX Oct 29th 2700/2725 call spreads for 4.45. Probably close this today.

Bye bye DubCal flock

EXPE STC @ 1.90 x2, BTO avg price @ 1.11 (win)

CMG STC @ 8, BTO @ 4.35 (win)

FSLR STC @ .90 x3, BTO @ .76 (win)

GILD STC @ 1.21 x2, BTO avg price .99 (win)

INTC STC @1.02 x4, BTO @ .57 (win)

MAT STC @ .30 x 8, BTO @ .19 (win)

SNAP STC @ .04 x10, BTO @ avg price .14 (loss)

WDC STC @ .01 x2, BTO @ avg price .93 (loss)

CHTR STC @ 1.66, BTO @ 3.53 (loss)

COG STC @ .69 x5, BTO @ .39 (win)

CL STC @ .10 x4, BTO avg price .45 (loss)

TSLA calls

#Earnings I sold the 300 way too early on Tuesday, before I heard their earnings date was moving. I’ll be selling a strangle later today.

BTC $TSLA Oct 26th 300 call for 13.00. Sold for 4.60 on Tuesday.

BTC $TSLA Oct 26th 330 call for 1.16. Sold for 2.05 on Tuesday.

AMZN

STO 1475/1500 bull put spread @ 1.75 for November 2 expiration.

BABA

#LongCalls #LEAPS – Earnings next week…

Bought to Close BABA OCT 26 2018 150.0 Calls @ .01 (sold for 2.20)

Sold BABA NOV 2 2018 150.0 Calls @ 2.02

Morning Action

#earnings

At the bell, filled on closing $GOOGL Oct 26th 1000/980 put spreads for .35. Condor sold yesterday for 3.00. I’ll let the calls expire.

Closed $INTC Oct26/Nov2 45 dbl calendars for 1.06. Bought yesterday for .54.

Closed $AMZN Oct 26th 1600/1575 put spreads for 2.70. Condor sold yesterday for 3.75. I’ll let the calls expire.

The $CL and $GILD dbl cals not faring as well. Waiting for a hopeful rise in the stocks.

My kinda chart

This might help a bit…

…at least for a few minutes.

BREAKING: First read on US Q3 GDP up 3.5%, vs 3.4% growth expected https://t.co/0KZE77VG3E

— CNBC Now (@CNBCnow) October 26, 2018

/nq

Fresh sell signal on 15 minute into close. Shorted at 7020 out at 6960 so profitable for the day.

Seems like the big moves occur early and late in the the day as people move stuff around to avoid margin.

SPX calls sold

#SPXcampaign I was trying to get a fill on this before the bell, but didn’t. Then I moved to sell it quickly as I saw both GOOGL and AMZN down sharply. Not looking good for the market tomorrow unless the conference calls get these higher.

Sold to Open $SPX Nov 2 2760/2785 call spreads for 6.25.

Double Calendars

#Earnings #DoubleCalendar

Followed Mama on three of these ideas…

Bought $CL Oct26/Nov2 64 dbl calendars for .44

Bought $INTC Oct26/Nov2 45 dbl calendars for .54

Bought $GILD Oct26/Nov2 70 dbl calendars for .95

TQQQ

In my IRA, I rolled my 58.5 calls from November 9, to November 16, 59 calls for a credit of .18 cents. These are against my 66.67 calls and I have 61 more weeks to go. I have covered 50% of my cost so far but am under water on the long dated position.

#earnings #ironcondor AMZN Following the…

#earnings #ironcondor AMZN

Following the AMZN condors, sold Nov. 16, 1450/1460/2010/2220 for 1.75, thanks all

#shortcalls #closing UVXY Oct. 23,…

#shortcalls #closing UVXY

Oct. 23, sold Jan. 18, 2019 112 call for 6.05, bought today for 4.99, like the deer running my neighborhood these days, I’m a little skittish.

LEAP covered calls

#LongLEAPs #SyntheticCoveredCalls

Sold $TQQQ Nov 2nd 58 calls for 1.20.

Sold $SQ Nov 2nd 77 calls for 1.20.

GOOGL condor

#Earnings #ironcondor

Sold to open $GOOGL Oct 26th 980/1000/1175/1195 condors for 3.00

Biggest UP move: 5.6% , Biggest DOWN move: -5.4% , Average move: 3.5%.

Stock is up to 1110, so my strikes are +5.9 and -9.9% OTM.

Some divergence

$SPX and indices up and moving toward 2%. However, $VIX opened lower but since then has been in consolidation. Tonight’s AMZN and GOOGL results may portend tomorrow’s open but I’m looking for a near-term peak to get short again. If we’re still going up on Monday I’ll start to reassess.

EWZ

#LongCalls #LEAPS – Filled on this just in time this morning leaving a 4×10 ratio’d position. Whiz says EWZ is going up big…LOL!

Bought to Close EWZ OCT 26 2018 40.0 Calls @ .05 (sold for .63)

#rolling and recovery Scalped a…

#rolling and recovery

Scalped a few more trades on /NQ and gave back my gains. But learned that 15 min and 30 minute chart is probably ideal for scalping. 1 and 5 minute too much chop. I will be adding some more directional trades and using my tools.

#fuzzy

XBI 80/97 rolled to 80/90 for 0.49 credit. Cb 17.84

LNG 50/66.5 rolled to 22 DTE 65 for 0.49 credit. Cb 17.84

XBI lot 1,2,3 closed for losses totaling 620. With only until Jan 2019 and hardly any cash in this account did not think it was worth trying to recover and losing more.

#pietrades

LNG Lot 1 66 cc rolled down to 65 and 43 DTE for 0.83 credit. Cb 60.99

LNG lot 2 66 cc rolled the same for 0.9 credit. cb 61.00

#supercharger all I had left for in this tiny IRA.

QQQ 22 DTE 150/155 for 4.53. Will have to manage if we drop more.

GOOGL earnings analysis

#Earnings

Look how docile GOOGL is… its range has been small, and I’ve usually skipped it due to lack of premium. But with IV up, premium is huge at the ranges below. If I go back to the 13th Quarter there was a 16% up move, so beware that despite the recent quiet, GOOGL can move big.

$GOOGL reports tonight after the bell. Below are details on earnings 1-day moves over the last 12 quarters.

July 23, 2018 AC 3.89%

April 23, 2018 AC -4.76%

Feb. 1, 2018 AC -5.28%

Oct. 26, 2017 AC 4.26%

July 24, 2017 AC -2.93%

April 27, 2017 AC 3.71%

Jan. 26, 2017 AC -1.39%

Oct. 27, 2016 AC 0.27%

July 28, 2016 AC 3.32%

April 21, 2016 AC -5.41%

Feb. 1, 2016 AC 1.31%

Oct. 22, 2015 AC 5.60%

Avg + or – 3.51%

Bias +0.22%, very slight upside bias on earnings.

With stock at 1095.00, the data suggests these ranges.

Based on current IV (expected move per TOS): 1035.20 to 1154.80

Based on AVERAGE move over last 12 quarters: 1056.56 to 1133.44

Based on MAXIMUM move over last 12 Q’s (5.6%): 1033.68 to 1156.32

Open for requests on other symbols.

AMZN condor

#Earnings #IronCondor

Sold to open $AMZN Oct 26th 1575/1600/1950/1975 condors for 3.75.

IV is jacked up on most, so it allows for wide strangles and condors. Biggest UP move: 13.2%, Biggest DOWN move: -7.6%, Average move: 4.7%. My trade is +11.4% on the upside and -8.3% on the downside. It is a bullish positioning because of the historical ranges, but even if we drop I don’t think we can get to 1600.

Whiz

100 percent sure it’s a dead cat today…heck if I know.

Another day, another DubCal

Today, I looked for cheap trades that met the criteria. There are way too many. I may add to these near the close.

Bot EXPE Oct26/Nov2 117 double cal @ 1.26

Bot FSLR Oct26/Nov2 42.5 double cal @ .76 x2

Bot GILD Oct26/Nov2 69 double cal @ 1.01

Bot INTC Oct26/Nov2 44 double cal @ .58 x2

Bot MAT Oct 26/Nov2 13.5c double cal @ .19 x4

Bot SNAP Oct26/Nov2 7c double cal @ .15 x5

Bot WDC Oct26/Nov2 54.5 double cal @ .99

Bot CL Oct26/Nov2 64 double cal @ .44 x2

Bot COG Oct 26/Nov2 21 double cal @ .39 x3

Have orders in to buy CHTR and CMG but the bid-ask is wide so nothing yet.

#earnings #shortstrangles #closing MSFT Yesterday…

#earnings #shortstrangles #closing MSFT

Yesterday sold Nov. 16, 95/115 strangle for 1.81, bought today for 1.21

AMZN trade

#Earnings Sold $AMZN Oct 26th 1710p/1740p/1740c/1770c #IronButterfly for 28.10.

Exited my mistake long for 28.10 and added the correct short IB.

This is 1.90 of risk for a max gain of 28.10. It’s impossible to make the full 28.10, but if price is within 28.10 from 1740 tomorrow, you’ll win. This is better than I get for this trade usually, I guess do to elevated volatility on the market. You can’t beat the R/R.

I’m going to try another later in the day, perhaps centered higher in the belief that the stock will go up tonight.

DUST up

#ContangoETFs Sold $DUST Jan 2019 45 call for 2.00

#shortstock #closing IMAX Oct. 19,…

#shortstock #closing IMAX

Oct. 19, sold short 100 shares at 22.48, bought to cover today for 20.81

BIIB adding

At a lower strike.

Sold $BIIB Jan 18 250 put @ 5.30.

DubCal update

Another profitable day playing earnings. I am getting nervous about these trades. If the market continues up, some of these could easily blow out to the upside for full loss. Gotta keep max risk in mind.:-)

STC TWTR @ 1.45 x2. Bot @ 1.29 (gain)

STC TSCO @ 1.65 x3. Bot @ 1.04 (gain)

STC MSFT @ 3.39. Bot @ 2.15 (gain)

STC SHOP @ 8.56. Bot @ 7.00 (gain)

STC GRUB @ 1.70. Bot @ 3.40 (loss)

CELG-TNA GLD-TQQQ UAA-SOXL bringing dead money alive

#CoveredCalls #IRA – Fuzzy, what the heck are you talking about? Good question!

In an IRA I’ve been carrying positions in CELG, GLD, and UAA that seems like it’s been forever. They’re all underwater with very little call premium available to sell. With this pullback I’m selling the dogs and putting an equal amount of cash into some tickers that do have nice premium and that have been beat down pretty hard.

I won’t bore you with the details but I’m hoping these are long term positions that I can sell against for many months. Nothing fancy with weeklies…just doing the monthlies as more of a set it and forget it. I’ll roll the losses of the dead money stocks into the cost basis of the new positions and go from there. I feel I’ll make a lot more progress with these than sitting and waiting on the dogs to come back.

Here’s the covered call sales of the new positions:

Sold TNA NOV 16 2018 65.0 Calls @ 2.00

Sold TQQQ NOV 16 2018 58.0 Calls @ 1.60

Sold SOXL NOV 16 2018 100.0 Calls @ 5.10

Coupla longs

#SPXcampaign Sold to open $SPX Oct 26th 2625/2600 put spreads for 2.20.

Bought to Open $SPY Nov 21st 283 calls for .66

Bullish action looks decent today, but a collapse wouldn’t surprise me. I’ll probably close the SPX spread later today, but may hold overnight.

Channeling @fibwizard With the volatility…

Channeling @fibwizard

With the volatility trying a few futures scalps. Full disclosure, I have done this before, just my job does not allow me to do it on work days. Off today, daughter home sick so figured I can make some money back. Entered at the green arrow but set stop to tight and triggered out 3 bars later while I was making breakfast for a $205 loss. But re-entered close to the lows as the signal is still valid. Will hold until I get an exit signal on the 15 minute chart.

AMZN earnings analysis

#Earnings $AMZN reports tonight after the bell. Below are details on earnings 1-day moves over the last 12 quarters.

July 26, 2018 AC 0.51%

April 26, 2018 AC 3.60%

Feb. 1, 2018 AC 2.87%

Oct. 26, 2017 AC 13.21% Biggest UP

July 27, 2017 AC -2.48%

April 27, 2017 AC 0.71%

Feb. 2, 2017 AC -3.54%

Oct. 27, 2016 AC -5.13%

July 28, 2016 AC 0.82%

April 28, 2016 AC 9.56%

Jan. 28, 2016 AC -7.60% Biggest DOWN

Oct. 22, 2015 AC 6.22%

Avg + or – 4.69%

Bias +1.56%, slight upside bias on earnings.

With stock at 1720.00, the data suggests these ranges.

Based on current IV (expected move per TOS): 1608.25 to 1831.75

Based on AVERAGE move over last 12 quarters: 1639.38 to 1800.63

Based on MAXIMUM move over last 12 Q’s (13.2%): 1492.79 to 1947.21

Open for requests on other symbols.

MSFT

closed Dbl Cal 3.66 cost 2.15 yesterday

covered some of the earnings play loss

TWTR

closed Dbl Cal 1.50 cast 1.25 yesterday

Thx MamaCash

UVXY

#LongPuts #IRA – Playing it in two different accounts. One more conservative since it’s an IRA that doesn’t allow naked call selling. Might sprinkle a few call spreads in but mostly just selling the puts. The other account allows naked call selling so I’ll be selling the puts more aggressively against those.

Sold UVXY NOV 16 2018 51.0 Puts @ 2.31

Sold UVXY NOV 2 2018 56.0 Puts @ 1.85

AMD Nov

Sold $AMD Nov 16 17 puts @ .72

Bear Market In Mid-2019?

#Market Pretty in-depth analysis, published Monday, but an interesting read and lots of historical data comparisons to geek out on.

Will The U.S. Stock Market Enter A Bear Market In Mid-2019?

https://seekingalpha.com/article/4213219-will-u-s-stock-market-enter-bear-market-midminus-2019

Hello Mr. UVXY…Didn’t recognize you. Have you lost weight?

#LongPuts #LEAPS – First of all let me apologize for the length. Feel free to skip it or skim it over the weekend or tell me I’m crazy…LOL

It’s been a crazy month so far but it has given us a great opportunity to observe the “new” UVXY and how it reacts during market turmoil. The timing has been great since it had it’s most recent split just two weeks before the craziness began. I don’t have any data to back this up but just going by feel and how it’s suppose to trade now it does seem that it’s moves haven’t been as violent as they were previously so the adjustment appears to be working. No guarantees of course. It could be trading at 150 before things calm down but it does seem unlikely.

After the spike of the summer of 2015 I have been almost exclusively shorting it by selling call spreads on spikes or splits. It’s worked but they are slow to profit since they are so far out in time and don’t decay quite as fast since they are sold closer to the money. It works but it requires the risk to be on the table for a long time tying up buying power.

With the “new and improved” UVXY I think there’s a better way. I am switching all of my short UVXY positions to the #LongPuts #LEAPS strategy. With UVXY being toned down a little we will still get the inevitable downward trend but possibly not quite as fast as before. This should allow more time to sell weekly positions against the long puts for basis reduction. With less violent spikes and slower decay the sales should be possible on both calls and puts.

With all that said, let’s look at some real world numbers. I’ll use my original position as an example.

When UVXY made it’s initial run into the 50’s I bought Jan 2021 50 strike puts. This was just 9 days ago and I paid 29.60 for them. Let’s round that to 30 for simplicity.

I feel it’s safe to assume that by Jan 2021 UVXY will be somewhere near a split adjusted price of 5 dollars. That’s a 45 dollar drop so with the 30 dollar purchase price of the puts there should be a 15 dollar gain there if nothing more is done but sit and wait.

Now let’s add the possibilities of some weekly sales. In 9 days I’ve already brought in 6 dollars of weekly sales using puts and calls. That will go straight to the bottom line of the 2021 position. Of course that type of premium won’t always be available. Some rolling will be required or sometimes the call sale risk will be too high during low volatility.

Let’s assume very conservatively that over the course of the trade an average of 50 cents per week per side can be brought in. That’s a dollar per week for 116 weeks. 116 dollars plus the 15 dollar gain on the put purchase could turn this into about a 130 dollar gain on each contract.

The beautiful thing about it is the only big chunk of buying power being used is the original cost of the long puts but a good part of that can be made up early in the trade before UVXY drops much. Premium available for weekly sales is pretty nice until UVXY falls into the low teens and it begins drying up.

I tried a strategy similar to this on the split before this most recent one. It turned out to be nicely profitable and I was only selling the put side against the position…and UVXY dropped so quickly I didn’t get too many of those sold. With a toned down product now I’m thinking this will work much better this time around. We’ll see!

So today I closed all of my pre-split call spreads at overall profits. This takes a lot of risk off the table and frees up buying power for the new UVXY strategy. I’m still holding a few post split spreads but looking to get out of those at close to even eventually.

Bought to Close UVXY2 DEC 21 2018 15.0/25.0 Bear Call Spreads @ .99 (sold for .84) loss

Bought to Close UVXY2 DEC 21 2018 20.0/30.0 Bear Call Spreads @ .55 (sold for .86) gain

Bought to Close UVXY2 DEC 21 2018 20.0/30.0 Bear Call Spreads @ .52 (sold for .85) gain

Bought to Close UVXY2 JAN 18 2019 12.0/17.0 Bear Call Spreads @ 1.10 (sold for 1.15) gain

Bought to Close UVXY2 JAN 18 2019 15.0/25.0 Bear Call Spreads @ 1.16 (sold for .99) loss

Bought to Close UVXY2 JAN 18 2019 20.0/30.0 Bear Call Spreads @ .65 (sold for .91) gain

Downside Warning

#VIXIndicator Another Downside Warning fired today with the VIX closing at 25.23. That’s the highest close of this correction (although the intraday high was on Oct 11th), and the highest VIX close since February 12th.

This is the 4th warning of this correction. After the initial Warning, additional warnings can sometimes signal the bottom, but not always.

Whew!

I skipped all earnings trades just to watch the carnage.

In the most benign trade ever:

Closed on GTC order: $GUSH Dec 45 calls for .25. Sold in August as part of a #StrangleRoll. My 21 puts are threatened….. that’s why I never sell puts in these things!

This is the panic flush

If we don’t bottom here or in the morning, that’ll be all she wrote.

TQQQ

#LongCalls #LEAPS – This is a pretty new position so I’ve been selling aggressively and non-ratio’d so that’s really helped to get off to a decent start. Letting the leash out a little on the next sale.

Bought to Close TQQQ OCT 26 2018 60.0 Calls @ .05 (sold for 1.82)

Sold TQQQ NOV 9 2018 57.5 Calls @ 1.05 (come and get those Mr. Market!)

NVDA TNA

#ShortPuts #IRA – Definitely want TNA for the long term. Not sure it’s going to stay low enough for any put exercises so going shorter term and more aggressively. With NVDA, I’d take a shot at over 50 percent off it’s high.

Sold TNA NOV 16 2018 55.0 Put @ 2.40 (a little early)

Sold NVDA DEC 21 2018 140.0 Put @ 2.56

SOXL

Rolled my 90 puts in December to February 80 puts for a credit of 2.85

#earnings #shortstrangles VLO sold Nov….

sold Nov. 16, 75/100 for 1.19

UVXY

#VXXGame Throwing one more out there…

Sold $UVXY March 112 call for 8.75. Adding to one sold for 5.25.

#shortcallspreads IYR IYR up today,…

#shortcallspreads IYR, SMH

IYR up today, sold Dec. 21, 78/80 for 1.00

SMH sold Dec. 21 90/95 for 2.26

UVXY

AZO DG

Two that I wouldn’t mind selling off a little….jeez 😦 Up strong on a lousy day.

NVDA Jan

Sold $NVDA Jan 18 120 puts @ 1.32.

Stock down 30% this month. Is it going down another 40% between now and January? Delta is 04. Basis would be around the 200 day moving average if assigned. In that unlikely event I’d be loading the boat with NVDA <120.

New low on SPX

But pretty far below the VIX highs. This is somewhat typical… the VIX will often spike to its highest point on the first major downdraft of a correction, the calm a bit even though the index sinks lower. We need a strong flush in the market to get this correction behind us. Although we just went lower on SPX (and NDX, and Dow yesterday) it doesn’t seem like that capitulation panic we usually get at the bottom.

LABU

Rolled my 2020, 115 calls to 2021 115 calls for a debit of 3.90

#shortputs OIH Sold Dec 18,…

#shortputs OIH

Sold Dec 18, 20 put for .79.

TNA

#LongCalls #LEAPS – This is a pretty new position so I’ve been selling aggressively and non-ratio’d so that’s really helped to get off to a decent start. Letting the leash out a little on the next sale.

Bought to Close TNA OCT 26 2018 70.0 Calls @ .05 (sold for 1.97)

Sold TNA NOV 9 2018 67.0 Calls @ 1.10 (come and get those Mr. Market!)

RTN

#LongCalls #LEAPS – Earnings tomorrow so clearing the decks for a fresh sale.

Bought to Close RTN NOV 2 2018 202.5 Calls @ .15 (sold for .70 yesterday)

Going out an extra week:

Sold RTN NOV 2 2018 195.0/205.0 Bear Call Spreads @ .60

#shortstock #closing EWG Oct. 18,…

#shortstock #closing EWG

Oct. 18, sold short 100 shares of EWG at 27.68, bought to cover today for 26.69.

LABU

#LongCalls #LEAPS – Very conservative here…

Bought to Close LABU NOV 9 2018 90.0 Calls @ .08 (sold for 1.73)

Sold LABU NOV 9 2018 70.0/80.0 Bear Call Spreads @ .30

#shortputs T Followed Fuzzball and…

Followed Fuzzball and Jeff from this morning, sold Jan, 31 put for 1.46 to go with my 104.486 shares and a covered Nov. 16, 35 call.

LABU OLED RTN SMH XBI UVXY

#LongCalls #LEAPS – Another day of LEAPS getting hit but weeklies doing their jobs. On the bright side after sitting down last night and looking at these types of trades with a fine tooth comb, a majority of the 2021 positions only require .05 to .15 per week to cover. It’s a long haul so just trying to avoid whipsaws now. Weekly safe spreads bringing in just 20 cents or so and letting them expire is the plan for the future until a recovery happens.

LABU: Added final long LEAP purchase to average down. Way underwater but still doable.

Bought to Open LABU JAN 15 2021 110.0 Call @ 8.00

OLED: Earnings next week so nice to get rid of these to sell again.

Bought to Close OLED OCT 26 2018 117.0 Call @ .05 (sold for 1.20)

Bought to Close OLED OCT 26 2018 120.0 Call @ .05 (sold for 1.20)

RTN: Earnings tomorrow. I’ll be selling something later today.

Bought to Close RTN OCT 26 2018 205.0 Calls @ .05 (sold for 2.05)

SMH: Double dip in this expiry…

Bought to Close SMH NOV 9 2018 106.0 Calls @ .05 (sold for .97)

Sold SMH NOV 9 2018 99.0 Calls @ .35

XBI:

Bought to Close XBI NOV 2 2018 89.0 Calls @ .05 (sold for .76)

UVXY:

Big post coming later on my big change in strateegery for trading this symbol. It changed so I am too. Hoping for more potential profit with less buying power used and less volatility within the position.

It’s raining double calendars

BTO GRUB Oct26/Nov16 112 dubcal @ 3.40

BTO TWTR Oct26/Nov16 29 dubcal @ 1.29 x3

BTO SHOP Oct26/Nov16 127 dubcal @ 7

BTO TSCO Oct26/Nov9 86.5 dubcal @ 1.04 x3

Done with earnings trades for today.:-)

#earnings