AMZN Nov 14 expiration, decided to close out today short leg first trying to maximize gain on small rally. I ended up giving up $2 by timing poorly.

BTC Nov 16 1640/1670 for 10.90, sold for 13 Monday, and STC Nov 16 1630/1660 for $13.60 sold for 12.10 – should have waited till end of day. I sold shortly after noon expecting a rally like last 2 days. Still trying to get this timing right.

Monthly Archives: November 2018

#shortcallspreads SPX sell 2720/2735 spread…

SPX sell 2720/2735 spread expiring today (30 min) for 0.75cr, expired worthless.

Also 2715/2725 spread for $1.70 also expired worthless. last 30 min.

EWW

#LongCalls #LEAPS – Triple selling these. Stops on previous two sales…

Sold EWW NOV 30 2018 43.5 Calls @ .38

BOIL

#BearCallSpreads – Selling these in the money. Worked great on the big spike a few years ago so trying again. Starting with just one…

Sold BOIL MAR 15 2019 50.0/60.0 Bear Call Spread @ 4.27

#shortstock XME Sold short 100…

#shortstock XME

Sold short 100 shares of XME for 30.50.

TRADES:

PBYI STO 11/30/18 23.0 CALLS @1.10

PBYI STO 11/16/18 22.0 CALLS @.56

SFIX STO 11/16/18 27.5 CALLS @.25 I have only these two stocks and their short puts and calls at this time. They are working well for me. Can’t be nervous tho’. All the above calls are covered.

And the winner is:

#fuzzies during the market volatility. Makes sense, the spread offsets both sides and the income from selling options helps cushion the drop.

Trying to get back into #pietrades but market not really cooperating at the moment.

I am not the directional…

I am not the directional guy but while eating lunch /NQ just pushed to new 20 day lows on a 5 minute chart and bounced fairly quickly. Not saying this is a bottom but on market profile there is a lot less volume here so any reversal is likely to snap back to 6865 fairly quickly.

What is @fibwizard showing?

Next big levels above that are 6977 and 7104. Big volume at the 6977 level.

SPX 1-dte sold

#SPXcampaign Sold to open $SPX Nov 15th (monthlys) 2560/2580-2765/2785 condors for 1.05. Stop trading at tomorrow’s close, but settling Friday morning. So I will be closing the full position tomorrow.

#shortstock CLR Sold short 100…

#shortstock CLR

Sold short 100 shares of CLR for 45.94.

AZO bucking the trend

One of the few pre-ER stocks that’s staying strong thru this downturn.

#preearnings

BOIL & DUST closed

#ContangoETFs I’m shedding one a day. I can’t roll these, as the current mania could keep going higher. They will have to be made up with multiple smaller premium trades after things settle down.

BTC $BOIL Jan 18th 45 call for 23.60. Sold for 2.40 (avg price) in Sept/Oct. Closed this morning before the move from 60 to 70. I have 4 ITM contracts remaining.

BTC $DUST Jan 18th 50 call for 1.10. Sold for 4.00 on Aug 16th.

Taking some profits

Lightening up to free up buying power

Bought to close:

$WHR Dec 21 90 puts @ .40. Sold for 1.40 on 10/9.

$KMB Jan 18 95 puts @ .45. Sold for 1.35 on 10/22.

$MLM Jan 18 150 put @ .90. Sold for 2.20 on 10/10.

$F Dec 21 9 puts @ .15. Sold for .42 on 9/7.

$SJM Jan 18 95 puts @ .97. Sold for 2.30 on 10/2.

$DUST Mar 15 49 call @ 2.50. Sold for 5.10 on 8/15.

$TNA Nov 16 57 puts @ .45. Sold for .50 on .50 on 11/12–getting out for near breakeven; may sell at a lower strike later.

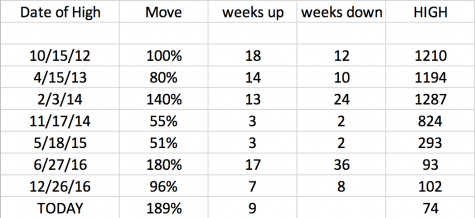

BOIL stats

#ContangoETFs I searched back for spikes on BOIL that were over 50%. Below is a chart with:

Date of the High

Percentage up from the recent low

Weeks it took to go UP low to high

Weeks it took to go back DOWN to the low (or at least in the neighborhood)

As you can see, from a percentage basis, this current spike is the highest. We also got here more quickly than other spikes above 100%. I don’t know whether we can say that this means we should be topping. But the freak out of current traders, being long oil and short NatGas, is largely responsible for what we’re seeing now.

We know it will drop again, but cannot say how long that will take or how high it will go first.

#earnings #shortstrangles CSCO Sold Dec….

#earnings #shortstrangles CSCO

Sold Dec. 21 41/49 strangle for 1.15, just outside the max moves, thanks Jeff.

CSCO earnings analysis

#Earnings $CSCO reports tonight. Below are details on earnings 1-day moves over the last 12 quarters.

Aug. 15, 2018 AC 2.96%

May 16, 2018 AC -3.76%

Feb. 14, 2018 AC 4.72%

Nov. 15, 2017 AC 5.18%

Aug. 16, 2017 AC -4.01%

May 17, 2017 AC -7.21% Biggest DOWN

Feb. 15, 2017 AC 2.37%

Nov. 16, 2016 AC -4.81%

Aug. 17, 2016 AC -0.78%

May 18, 2016 AC 3.18%

Feb. 10, 2016 AC 9.64% Biggest UP

Nov. 12, 2015 AC -5.82%

Avg (+ or -) 4.54%

Bias 0.14%, no significant bias on earnings.

With stock at 45.00 the data suggests these ranges.

Based on current IV (expected move per TOS): 42.29 to 47.71

Based on AVERAGE move over last 12 quarters: 42.96 to 47.04

Based on MAXIMUM move over last 12 Q’s (9.6%): 40.66 to 49.34

Open for requests on other symbols.

SPX 1-dte closed

#SPXcampaign BTC $SPX Nov 14th 2645/2625 put spread for .15. Condor sold yesterday for 1.15. Leaving calls to expire.

WMT earnings analysis

#Earnings $WMT reports tomorrow morning. Below are details on earnings 1-day moves over the last 12 quarters.

Aug. 16, 2018 BO 9.33%

May 17, 2018 BO -1.90%

Feb. 20, 2018 BO -10.17% Biggest DOWN

Nov. 16, 2017 BO 10.89% Biggest UP

Aug. 17, 2017 BO -1.58%

May 18, 2017 BO 3.22%

Feb. 21, 2017 BO 2.99%

Nov. 17, 2016 BO -3.08%

Aug. 18, 2016 BO 1.87%

May 19, 2016 BO 9.58%

Feb. 18, 2016 BO -3.01%

Nov. 17, 2015 BO 3.54%

Avg (+ or -) 5.10%

Bias 1.81%, positive bias on earnings.

With stock at 102.00 the data suggests these ranges.

Based on current IV (expected move per TOS): 96.98 to 107.02

Based on AVERAGE move over last 12 quarters: 96.80 to 107.20

Based on MAXIMUM move over last 12 Q’s (10.9%): 90.89 to 113.11

Open for requests on other symbols.

NTES earnings analysis

#Earnings $NTES reports tonight. Below are details on earnings 1-day moves over the last 12 quarters.

Aug. 8, 2018 AC -10.96%

May 16, 2018 AC -7.45%

Feb. 7, 2018 AC -6.27%

Nov. 15, 2017 AC 7.85%

Aug. 9, 2017 AC -9.77%

May 10, 2017 AC -0.82%

Feb. 15, 2017 AC 14.08% Biggest UP

Nov. 9, 2016 AC -9.22%

Aug. 17, 2016 AC -2.67%

May 11, 2016 AC 0.43%

Feb. 24, 2016 AC -14.80% Biggest DOWN

Nov. 11, 2015 AC 2.17%

Avg (+ or -) 7.21%

Bias -3.12%, negative bias on earnings.

With stock at 219.00 the data suggests these ranges.

Based on current IV (expected move per TOS): 202.42 to 235.58

Based on AVERAGE move over last 12 quarters: 203.22 to 234.78

Based on MAXIMUM move over last 12 Q’s (14.8%): 186.59 to 251.41

Open for requests on other symbols.

#shortputs SLB Sold Nov. 16,…

#shortputs SLB

Sold Nov. 16, 47 put for .32, thanks Iceman

#shortcallspreads AMZN Trying my luck…

#shortcallspreads

AMZN

Trying my luck with these again, yesterday sold 1640/1670 Nov 16 spread for $13, added 1630/1660 at $12. I think I sold at bottom. It rose $10, then settled at $2 profit on 1640/1670 trade and small loss on 1630/1660. Today began with a spike upward and now settling back down into profitable area for 1640/1670. It expires Friday with a rich premium if I can hold it that long. The price gyrations are quite upsetting since I was out of synch with price action. It is one to keep an eye on if you like action.

#earnings #closing #shortstraddle M Bought…

#earnings #closing #shortstraddle M

Bought straddle for 4.15, sold yesterday for 4.98.

SPX calls closed

#SPXcampaign On this morning’s strength, don’t want to get stuck in this one if we continue higher, so taking a smaller loss now rather than facing a bigger roll decision in a few days.

BTC $SPX Nov 30th 2790/2815 call spreads for 7.35. Sold for 6.25 yesterday.

Feb Dec put spread

Sold $FB Dec 21 130/120 BuPS @ 1.20. IV rank is still high at 55. Delta of short strike is 20.

TQQQ

I rolled my 61 calls in December 21 to the 49 calls in December 21 for a credit of 3.85, I will roll if I have to.

Jeff all texts here sent…

Jeff all texts here sent to me by email.

I am having all text here as emails, I did not put a check mark in Notify me of new comments via email. I appreciate if you would let me know how can I fix it. Also I can not replay to comments because there are no replay under the comments. However, I can replay to comments if there are 1 or 2 replied to the comments because I can see the reply sign underneath it, but not under a message with no replay.

For example, I can not replay to your comment today:

SPX 1-dte

#SPXcampaign Sold to Open $SPX Nov 14th 2625/2645/2775/2795 condors for 1.15. Expires tomorrow. Stop is 10 points before short strikes. because there is a replay underneath it.

I only can replay to the following comment because thomberg1201 replied to Ramie comment, please see underneath:

Ramie 2 hours ago

AAPL Falling Knife

This seems safe but who knows…

Sold $AAPL Jun 21 2019 130 puts @ 1.30

Hide Comments

thomberg1201 an hour ago

I sure hope that is safe

Reply Like

#shortputs SQ Sold Dec. 21,…

#shortputs SQ

Sold Dec. 21, 65 put for 2.50.

TQQQ

STO December 21, 49 calls @ 4.60, I will start to roll these when we get to 3 weeks before expiration. I need .15 cents per week to pay for this last purchase so I have just covered 30 weeks of my trade.

STO $SPX Nov 14, 2018…

SPX expiring tomorrow Nov 14, 2018

STO $SPX Nov 14, 2018 2785/2790 BeCS @0.25

SPX 1-dte

#SPXcampaign Sold to Open $SPX Nov 14th 2625/2645/2775/2795 condors for 1.15. Expires tomorrow. Stop is 10 points before short strikes.

AAPL Falling Knife

This seems safe but who knows…

Sold $AAPL Jun 21 2019 130 puts @ 1.30

TNA

#ShortPuts #IRA – Replacing the ones closed earlier…

Sold TNA NOV 30 2018 60.0 Puts @ 2.25

TGT 3rd batch

#Earnings BTO $TGT Nov 23rd 89 calls for 1.05. Avg price on full position: 1.31.

This market is NOT allowing these trades to work. This is supposed to be closed before earnings, so next Monday (earnings Tues morn). We’ll have to see market strength into the weekend for this to have a shot.

#earnings #shortstraddle M Sold Dec….

#earnings #shortstraddle M

Sold Dec. 21, 36 straddle for 4.98, M is at 36.08, a little risky but a low priced stock.

$BA bouncing

Back above the 200 dma. Sold $BA Dec 21 320/310 BuPS @ 1.33

TNA TQQQ SOXL

#CoveredCalls – From what I can tell so far I think all of these will make very good long term covered call candidates. Would love to own ’em all at a low basis for nice income generation. Compared to regular dividend stocks I think these can blow those returns away. More volatile but that’s great for the selling…

TRADES:

SFIX STO 11/16/18 26.5 CALLS .55

SFIX STO 11/16/18 27.0 CALLS @.40 Completes my ladder.

M reports in the morning

#Earnings I missed this on my side chart: $M (Macy’s) reports Wednesday morning.

TNA

#ShortPuts #IRA – Closing these a little early hoping to re-load on any weakness…

Bought to Close TNA NOV 16 2018 55.0 Puts @ .25 (sold for 2.40 and 2.95)

XBI

#LongCalls #LEAPS – These only need 50 bucks a week so staying careful with spreads…

Sold XBI DEC 7 2018 84.0/89.0 Bear Call Spreads @ .61

SMH

#LongCalls #LEAPS – Got out of half of this week’s so I can get the next sale going on the bounce. Still sitting on my nickel for the rest…

Bought to Close SMH NOV 16 2018 100.0 Calls @ .04 (sold for .58)

Sold SMH NOV 23 2018 97.0 Calls @ .45

#earnings #rolling TEVA October 31,…

SPX bearish

#SPXcampaign Sold to Open $SPX Nov 30th 2790/2815 call spreads for 6.25.

#shortputspread AAPL Tradewise recommendation, Dec….

#shortputspread AAPL

Tradewise recommendation, Dec. 14, 185/187.50 for .77

OXY

STO May 17, 85 covered calls @1.10

I bought the stock when I thought oil was going up. Nice dividend of 4.13% plus the covered calls.

BOIL strikes

#ContangoETFs Surge continues. New strikes added up to 66.

CAH

#ShortPuts #IRA – Nice rally right up to resistance so booking it…

Bought to Close CAH JAN 18 2019 45.0 Puts @ .25 (sold for 1.95)

UNG

TQQQ

#CoveredCalls – Selling another batch staying prior to the G20 summit. Whiz says if any good news comes out of there the rally is on…

Sold TQQQ NOV 30 2018 55.0 Calls @ 1.19

TQQQ

#CoveredCalls – Partial fill…

Bought to Close TQQQ NOV 16 2018 58.0 Calls @ .05 (sold for 1.62)

SPX condor closed

#SPXcampaign BTC $SPX Nov 30th 2675/2700/2875/2900 condor for 7.95. I legged into this condor for 11.25 total. Had to close it today… all the profit came from the call side.

#shortcallspreadscall SPX sell 2735/2750 Nov…

SPX sell 2735/2750 Nov 12 calls for $6.70cr, quick drop $4 now, bottomed $3.50 watching for return.

SPX 1-dte closed

#SPXcampaign Bought to close $SPX Nov 12th 2730/2710 put spread for 1.20, breakeven covering commissions of the condor sold for 1.25 on Friday. I was trying to change my order for a lower price, but it drops so quickly on the tiniest of bounces that it grabbed my bid before I could change it.

I’ve been discussing these trades with some people today and comparing performance. I think one of my weak spots is entering these trades too late in the day, and also after a bounce has already dropped volatility dramatically. I believe if I had entered this condor an hour earlier on Friday, I could have been 20 or 30 points farther out of the money. I’ll be watching this closely for a good entry tomorrow for Wednesday expiration.

A couple of short term short volatility trades

Bought to open (bear put spread): $VXX Nov 30 36/31 BePS @ 2.47 debit

Sold to open (bear call spread): $UVXY Nov 23 60/70 BeCS @ 1.29 credit

GS against the grain

Going the other way on $GS. Not at all calling a bottom, just saying that if it gets down to the strike (another 13% lower from here) I’d be willing to buy the stock at what would be around a 2 year low.

Sold $GS Dec 21 180 puts @ 1.45. Delta of the puts is 12. Basis if assigned 178.55.

AMZN Dec put spread

Sold $AMZN Dec 21 1470/1450 BuPS for 3.41. Short strike (delta 18) is below the recent low from 10/30 (1476 intraday).

OLED Dec

Sold $OLED Dec 21 70 puts @ 1.45. Stock at 86.65/Delta 14.

#shortcallspreads SPX BeCS sell 1750,…

SPX BeCS sell 1750, buy 1770 calls expiring today for $5.50, a little slow on draw, got below $3, now $3.60 looking like it’ll take another dive.

Blood bath resumes

#Market Well, so much for the post-election rally. AAPL getting whacked, unlike in October, so it seems all bets are off. We could just remain in this wide range into year end, but things are not pretty with two days in a row like this.

Had to stop out on $TWLO puts with a loss… a painful whipsaw for me on the earnings trade. Staying away for now as it is still dropping.

No TSLA trade this week because margin req are jacked on that ticker by my broker.

BTC $DUST Mar 15th 60 call for 1.15. Sold for 3.65 (avg price) in Aug/Sept)

Stopped $BOIL Mar 15th 45 call for 8.00. Sold for 2.40, avg price. Working on some rolls to the new 60 strikes..

HD earnings analysis

#Earnings $HD reports tomorrow morning. Below are details on earnings 1-day moves over the last 12 quarters. (I checked 5-day moves and the only value higher than those below was a +7% move for Nov 2015)

Aug. 14, 2018 BO -0.53%

May 15, 2018 BO -1.62%

Feb. 20, 2018 BO -0.13%

Nov. 14, 2017 BO 1.63%

Aug. 15, 2017 BO -2.65%

May 16, 2017 BO 0.59%

Feb. 21, 2017 BO 1.41%

Nov. 15, 2016 BO -2.56%

Aug. 16, 2016 BO -0.60%

May 17, 2016 BO -2.46%

Feb. 23, 2016 BO 1.36%

Nov. 17, 2015 BO 4.41%

Avg (+ or -) 1.66%

Bias -0.10%, no significant bias on earnings.

With stock at 185.00 the data suggests these ranges.

Based on current IV (expected move per TOS): 176.22 to 193.78

Based on AVERAGE move over last 12 quarters: 181.92 to 188.08

Based on MAXIMUM move over last 12 Q’s (4.4%): 176.84 to 193.16

Open for requests on other symbols.

UVXY

#LongPuts #LEAPS #ShortCalls – Taking a little risk off and looking for new sales…

Bought to Close UVXY NOV 23 2018 75.0 Call @ .75 (sold for 2.55)

Bought to Close UVXY NOV 30 2018 80.0 Call @ 1.09 (sold for 6.32)

New highest strikes for BOIL

Up to 60 in most expirations

Sold:

$BOIL Dec 21 60 calls @ 2.60

$BOIL Jan 18 60 calls @ 4.30

TQQQ

In my IRA, BTO January 2021 60 calls @14.96 and will sell short dated calls on an uptick.

TQQQ calls

#SyntheticCoveredCalls #LongLEAPs

BTC $TQQQ Nov 16th 59 calls for .15. Sold for 1.25 last Wednesday

Expirations and Trade

Been off the grid for the last two weeks.

Started up again this week.

Glad to be back in the bistro.

#optionsexpiration

$SPX 2745/2755 BUPS Inspired by @jeffcp66. Thank you.

$WTW 72 calls (covered) Still own stock at rock bottom price 😉

$BABA 155 calls (covered)

$AAPL 207.5 calls (covered)

#earnings

$TWLO 60/83 strangle STO @ 2.23 BTC @ 8.00

$Z 34/47 strangle STO @ 1.50 Will be assigned shares at 34 Basis 32.5

Trade

$AMZN STO 11/16 1575/1625 BUPS at 5.50 Thank you @ramie77

Great weekend to all and thanks to all the veterans who served our country.

SPX 1-dte

#SPXcampaign Sold to Open $SPX Nov 12th 2710/2730/2815/2835 for 1.25. Expires Monday.

Happy Veteran’s Day

@jeffcp66 Love the wallpaper and the free golf in Nassau County courses on Sunday

#shortstock PAG Nov. 2, sold…

#shortstock PAG

Nov. 2, sold 100 shares short for 45.08, bought to cover today for 44.04, however I missed ex-div yesterday so will pay the .37 dividend.

#shortcallspreads TSLA Following Iceman’s TSLA…

#shortcallspreads TSLA

Following Iceman’s TSLA concept, sold Nov. 16, 370/380 for 1.29.

TQQQ

In my IRA, BTO January 2021, 60 calls @15.60, need .14 cents per week to break even.

#earnings #ironbutterfly #closing DIS Yesterday…

#earnings #ironbutterfly #closing DIS

Yesterday sold Nov. 16, 105/115/115/125 for 4.27, essentially a straddle with protection, bought to close the shorts for 3.66. Leaving the longs that are with about 2.00 each, Disney lotto, stock is at 117.

Econ Calendar for week of 11/12/18

Maybe not so long

#LongCallSpread Not a sunny day for bulls. Bought this yesterday but no going to watch it bleed away if this market is in a new downtrend.

Sold to close $AMZN Nov 23rd 1800/1810 long call spreads for 2.00. Bought yesterday for 2.70.

SPX rolled

#SPXcampaign Sold $SPX Nov 23rd 2630/2650/2850/2870 condors for 2.80, as a roll from 1-dte spread stopped earlier. I’ll stop this if premium on either side doubles to 5.60.

ATVI Dec

Sold $ATVI Dec 21 50 puts @ 1.10 with the stock at 55.62. Premium is better now.